Higher Taxes, Broken Promises and External Pressure: Who Decides, Who Pays, and Where Did the People’s Will Go?

In recent months, a growing number of citizens have begun to view the current government through a lens of deep distrust. This is no longer about isolated complaints or marginal criticism, but about a widespread public perception: that major decisions are being taken far away from the real will of the people, and that the outcome of elections appears, for many, to have been distorted by backroom deals and opportunistic political arrangements.

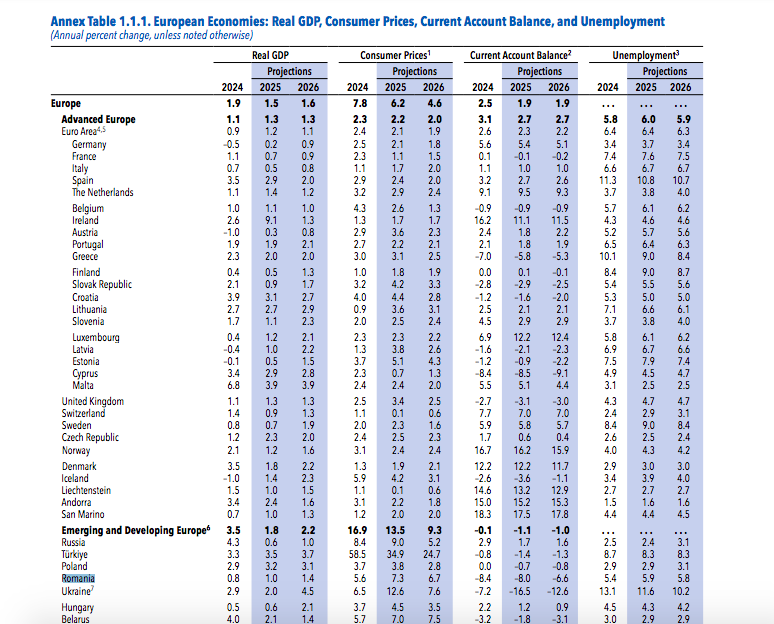

In this already tense climate, announcements regarding massive tax increases acted as a catalyst. According to public statements made by authorities, the fiscal measures prepared or already adopted are expected to lead to cumulative increases of up to 70% for certain taxes and contributions. Even when these figures are presented in technical, fragmented or staggered terms, the impact felt by the population is severe.

The problem is not only the scale of these increases, but the stark contrast between pre-election rhetoric and post-election reality. Public records include clear statements made before the vote by prominent political figures, including Nicușor Dan, assuring voters that taxes would not be raised. Today, the same authorities justify the new measures through a mix of "necessity," "fiscal responsibility," and "external pressures."

This gap between promise and action fuels a deeply corrosive perception: that votes were requested on one platform, while governance is carried out on another. For a significant segment of society, this amounts to the belief that power was obtained formally, but is now exercised against the declared public interest.

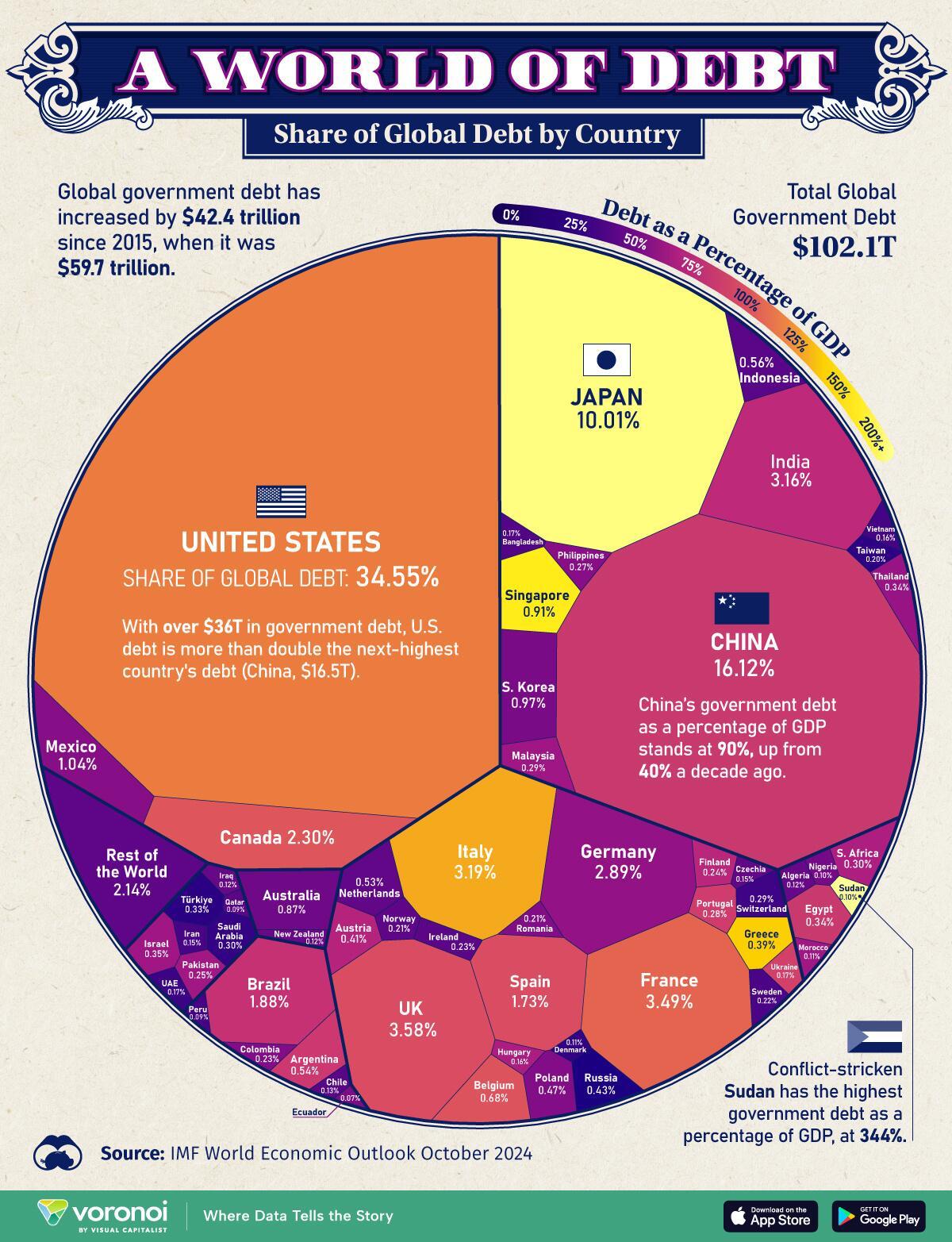

At the center of official justifications, one name repeatedly appears: the International Monetary Fund. IMF recommendations regarding deficit reduction, increased fiscal revenues, and so-called "structural adjustments" are invoked as a final argument. Yet the IMF does not legislate and does not govern. It recommends. The decision to apply those recommendations belongs entirely to the government.

This leads to another legitimate question: why do these adjustments appear to be implemented almost exclusively through increased pressure on the general population, rather than through genuine reform of the state apparatus, reduction of waste, elimination of privileges, or restructuring of an oversized administrative system? Why does the solution always seem to be the same: more taxes for the many, and silence when it comes to accountability at the top?

In public discourse, a growing idea is taking shape: that the current political class functions as a compliant intermediary between external demands and the domestic bill to be paid. For ordinary citizens, this dynamic is perceived not as responsible governance, but as a transfer of decision-making sovereignty - a form of "selling out" national interests in exchange for international approval.

The fact that these decisions are taken at a time when public trust is already fragile only amplifies the social reaction. For many, this is no longer just about taxes, but about legitimacy: who decides, on whose behalf, and with what real mandate?

When public perception begins to associate governance with ideas of imposture, power capture, and contempt for electoral promises, the issue ceases to be purely economic. It becomes a political and moral crisis. Ignoring this reality risks transforming latent frustration into an open rupture between the state and its citizens.

0 Comments

There are no comments on this article.